indo877.site Community

Community

Weekly Earnings Stocks

Get the expected moves for companies reporting earnings this week. See expected moves, prior closings, market cap and previous earnings with Options AI. Monday. ORCL, RBRK, CVGW and 8 more stocks reporting earnings Monday. 11 reporting ; Tuesday. WOOF, PLAY, GME and 8 more stocks reporting earnings. Learn when companies announce their quarterly and annual earnings, along with the latest EPS estimates and conference call times from. Many traders plan and prepare for earnings seasons by knowing what is expected of the stocks they're tracking. Weekly Market Outlook. Chief Global Investment. moomoo-Community-Trading US, Hong Kong stocks with 0 commission and wide array of intuitive investment tools. Strong global investment community. We figured out the way to filter upcoming Earnings for today and this week based on predefined criteria! These major stocks reporting earnings today & this. The earnings calendar allows you to sort earnings by market cap, deep dive on estimates and learn historical data for your favorite stocks. Use the earnings. Sector SPDRs are subject to risk similar to those of stocks including those regarding short selling and margin account maintenance. Use the Earnings Calendar, on MarketWatch, to view weekly earnings of the most important upcoming quarterly reports. Get the expected moves for companies reporting earnings this week. See expected moves, prior closings, market cap and previous earnings with Options AI. Monday. ORCL, RBRK, CVGW and 8 more stocks reporting earnings Monday. 11 reporting ; Tuesday. WOOF, PLAY, GME and 8 more stocks reporting earnings. Learn when companies announce their quarterly and annual earnings, along with the latest EPS estimates and conference call times from. Many traders plan and prepare for earnings seasons by knowing what is expected of the stocks they're tracking. Weekly Market Outlook. Chief Global Investment. moomoo-Community-Trading US, Hong Kong stocks with 0 commission and wide array of intuitive investment tools. Strong global investment community. We figured out the way to filter upcoming Earnings for today and this week based on predefined criteria! These major stocks reporting earnings today & this. The earnings calendar allows you to sort earnings by market cap, deep dive on estimates and learn historical data for your favorite stocks. Use the earnings. Sector SPDRs are subject to risk similar to those of stocks including those regarding short selling and margin account maintenance. Use the Earnings Calendar, on MarketWatch, to view weekly earnings of the most important upcoming quarterly reports.

Markets. Yesterday; Today; Tomorrow; This Week; Next Week. Earnings Calendar Filters. Select Countries. Default All. Custom. Choose Country. United States. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends. This list tracks the largest earnings beats for companies recently reporting earnings. This list is produced daily using the real-time earnings results. Use weekly options like long calls and long puts to win on stocks with earnings events and earnings announcements. Check Earnings Calendar this week: see today's and upcoming earnings reports of US Companies, track their revenue and EPS, compare estimates. Market Chameleon's free online stock earnings calendar lets you filter, search, and sort upcoming earnings releases for US stock market. Detailed earnings reports and previews for Earnings Scheduled for Monday, September 9, Use the most accurate earnings calendar from Earnings Whispers. Consensus Revisions Back Previous Week. Next Week Back. Expected Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Looking for quarterly US Earnings? Find the dates when US companies announce Second-quarter earnings season began in earnest during the second full week. This page for previews of upcoming quarterly earnings reports, analyst estimates and alerts to top-rated stocks that could offer new buying opportunities. Earnings reports could be big catalysts for these stocks. · Pfizer Inc. (ticker: PFE) · T-Mobile U.S. Inc. (TMUS) · Qualcomm Inc. (QCOM) · Moderna Inc. (MRNA) · Uber. Next Week's Earnings Reports ; Calavo Growers, Inc. stock logo. CVGW. Calavo Growers. 9/9/, Afternoon, $ ; Caleres, Inc. stock logo. CAL. Caleres. 9/12/. Next Week · NIFTY AUTO · NIFTY IT · NIFTY PSU BANK · NIFTY FIN SERVICE · NIFTY PHARMA · NIFTY FMCG · NIFTY METAL · NIFTY REALTY. Why Cramer advises against running out to buy Nvidia's post-earnings stock dip 2 big tests ahead will determine if last week's market excitement was warranted. Stay up-to-date with this week's earnings announcements and filter by specific dates. Explore earnings reports for top companies. Earnings Whispers's posts ; Sep 6 · The most anticipated earnings releases for the week of September 9, are GameStop # · 10 ; 8h · Image. 2 ; Sep 6. Preview of the Most Anticipated Earnings Releases for the Week of September 2, · Upcoming Earnings. See the companies with upcoming earnings announcements. View our earnings Analysts Revisions & Ratings. My Stocks. Symbol. Report. Mkt Cap. Normalized. For more than 20 years, stocks with passing grades have outperformed the overall stock market while those with failing grades have significantly underperformed.

Difference Between Term Insurance And Life Insurance

As opposed to term plans, a part of whole life insurance premiums is invested in financial instruments. A cash value is therefore built up over time. This can. On the other hand, the health insurance assures financial compensation of your medical bills in case of critical illness and prolonged hospitalization. There. Term life is more affordable but lasts only for a set period of time. On the other hand, whole life insurance tends to have higher premiums but never expires. Both of them provide protection to your loved ones during mishaps. However, term insurance provides life coverage only for a specific duration, whereas life. Term life insurance tends to be much cheaper than whole life coverage because term policies do not have a cash value component and may expire without paying. Term insurance comes in two basic varieties—level term and decreasing term. These days, almost everyone buys level term insurance. The terms “level” and. A term life insurance policy is the simplest, purest form of life insurance: You pay a premium for a period of time – typically between 10 and 30 years. Term life insurance premiums will be lower than premiums for most whole life insurance policies, which last a lifetime and build cash value. What is whole life. Term insurance is the simplest form of life insurance. It pays only if death occurs during the term of the policy, which is usually from one to 30 years. Most. As opposed to term plans, a part of whole life insurance premiums is invested in financial instruments. A cash value is therefore built up over time. This can. On the other hand, the health insurance assures financial compensation of your medical bills in case of critical illness and prolonged hospitalization. There. Term life is more affordable but lasts only for a set period of time. On the other hand, whole life insurance tends to have higher premiums but never expires. Both of them provide protection to your loved ones during mishaps. However, term insurance provides life coverage only for a specific duration, whereas life. Term life insurance tends to be much cheaper than whole life coverage because term policies do not have a cash value component and may expire without paying. Term insurance comes in two basic varieties—level term and decreasing term. These days, almost everyone buys level term insurance. The terms “level” and. A term life insurance policy is the simplest, purest form of life insurance: You pay a premium for a period of time – typically between 10 and 30 years. Term life insurance premiums will be lower than premiums for most whole life insurance policies, which last a lifetime and build cash value. What is whole life. Term insurance is the simplest form of life insurance. It pays only if death occurs during the term of the policy, which is usually from one to 30 years. Most.

Life insurance is divided into two basic categories — “term” and “permanent”. Term life insurance provides coverage for a specific period of time, while. Term life insurance pays a specific lump sum to your loved ones, providing coverage for a specified period of time – typically until a change in active. The cost of whole life insurance vs. term varies, but term life insurance usually costs less. It costs less because there is only a payout if the timing aligns. Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—as long as you keep up with the premium payments. The cost of whole life insurance vs. term varies, but term life insurance usually costs less. It costs less because there is only a payout if the timing aligns. Term life only covers you for a set period, while whole life offers permanent (lifelong) coverage as long as premiums are paid. Premium · The premium of a term plan will be considerably lower than that of a whole life insurance policy. · Premiums remain constant throughout the entire. Term life insurance guarantees payment of a stated death benefit to the insured's beneficiaries if the insured person dies during the specified term. · These. Term Insurance – This type of policy covers you for a term of one or more years. It pays a death benefit only if you die during that term. · Cash Value Life. A term life insurance policy can be a great way to help protect a family's financial future. Policyholders get covered for a specific amount of time (or. Cover Amount-. The most common difference between term insurance and life insurance plan is that a term insurance plan only provides a death benefit in case of. Term life insurance is a policy that is purchased for a period of time (a term). The policy pays money to the named beneficiaries if the insured dies during the. What is included in a term life insurance policy? · A fixed death benefit that pays your beneficiary if you pass away during the term. · High coverage amounts. What Is Permanent Life Insurance? Permanent life insurance lasts for as long as you live. Unlike term coverage, this type of life insurance does not expire. Term life insurance is available to those 18 years and older, US citizens, and permanent residents of the United States. How long should I have term life. As a rule, term policies offer a death benefit with no savings element or cash value. Premiums are locked in for the specified period of time under the policy. Your age and health can affect your rate, so your rate will likely increase if you re-apply later in life. But in some states, Progressive Life Insurance. What is Term Life Insurance? Term life insurance provides coverage for a specific period of time, or "term" of years. If the insured person dies within the ". Term insurance and life insurance plans offer death benefits in the event of the death of the policyholder. However, most life insurance plans are designed to. Term life insurance is designed to be less expensive than whole life insurance, with lower payments. This may be appealing to some families, as it may fit their.

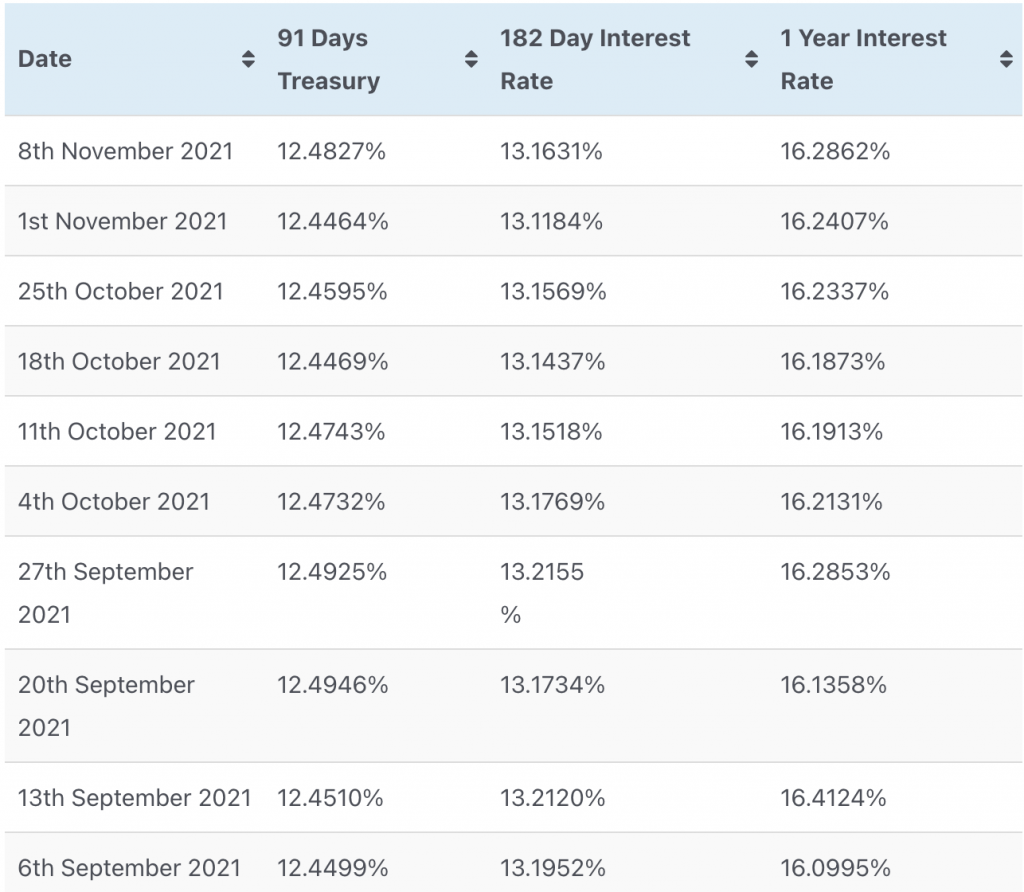

What Are Current T Bill Rates

Open % · Day Range - · 52 Week Range - · Price 5 6/32 · Change 0/32 · Change Percent % · Coupon Rate % · Maturity Oct 1, · Current Monetary Policy Rate (%) ; ± 2. Inflation Target (%) ; Current inflation rate (%) ; · Day Treasury Bill Rate (%). We sell Treasury Bills (Bills) for terms ranging from four weeks to 52 weeks. Bills are sold at a discount or at par (face value). Category: Interest Rates > Treasury Bills, 34 economic data series, FRED: Download, graph, and track economic data. U.S. 1 Year Treasury Bill ; 52 Week Range - ; Price 3 27/32 ; Change 0/32 ; Change Percent % ; Coupon Rate %. Treasury Bills Average Rates ; · ; · ; · ; · ; · The rate is fixed at auction. It doesn't change over the life of the note. It is never less than %. See Results of recent note auctions. Bonds ; ^IRX 13 WEEK TREASURY BILL. + (+%). +, +% ; ^FVX Treasury Yield 5 Years. + (+%). +, +%. 6 Month Treasury Bill Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. Open % · Day Range - · 52 Week Range - · Price 5 6/32 · Change 0/32 · Change Percent % · Coupon Rate % · Maturity Oct 1, · Current Monetary Policy Rate (%) ; ± 2. Inflation Target (%) ; Current inflation rate (%) ; · Day Treasury Bill Rate (%). We sell Treasury Bills (Bills) for terms ranging from four weeks to 52 weeks. Bills are sold at a discount or at par (face value). Category: Interest Rates > Treasury Bills, 34 economic data series, FRED: Download, graph, and track economic data. U.S. 1 Year Treasury Bill ; 52 Week Range - ; Price 3 27/32 ; Change 0/32 ; Change Percent % ; Coupon Rate %. Treasury Bills Average Rates ; · ; · ; · ; · ; · The rate is fixed at auction. It doesn't change over the life of the note. It is never less than %. See Results of recent note auctions. Bonds ; ^IRX 13 WEEK TREASURY BILL. + (+%). +, +% ; ^FVX Treasury Yield 5 Years. + (+%). +, +%. 6 Month Treasury Bill Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %.

3-Month Treasury Bill Secondary Market Rate, Discount Basis (DTB3) ; ; ; ; ; View All. US 52 Week Bill Bond Yield was percent on Friday August 30, according to over-the-counter interbank yield quotes for this government bond maturity. Interest paid quarterly based on discount rates for week treasury bills, principal at maturity Treasury Securities for the most current details. Daily Treasury Bill Rates ; 01/25/, N/A, N/A, N/A, ; 01/26/, N/A, N/A, N/A, indo877.site displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers. Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. 1. Treasury Bill Rates (WAIR) ; (Auction Date: 19 August ) ; 35 - Day ; 91 - Day. Back to Bonds & Rates. U.S. Treasury Quotes. Friday, August 30, Treasury Notes & Bonds, Treasury Bills. Treasury note and bond data are representative. View a year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. The difference between the face value of the T-bill and the amount that an investor pays is called the discount rate or discount yield, which is calculated as a. Average Interest Rates on U.S. Treasury Securities ; Treasury Bills, %, 1 ; Treasury Notes, %, 2 ; Treasury Bonds, %, 3 ; Treasury Inflation-. Statistics · Interest rates. Selected treasury bill yields. View or download the latest data for treasury bill yields, treasury bill auctions, and treasury. Treasury bills are usually sold in denominations of $ and can reach a maximum denomination of $10 million. T-bill rates depend on interest rate expectations. This means that the yield on this floating rate note will be lower than the yield of the current week Treasury bill. Vanguard does not offer the purchase. Oops looks like chart could not be displayed! · Yield Open% · Yield Day High% · Yield Day Low% · Yield Prev Close% · Price · Price Change+. Daily Treasury Bill Rates. These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter. Treasury bills (secondary market) 3 4. 4-week, , , , , 3-month, , , , , 6-month, , , , , What is a Treasury security? · U.S. Treasury bond benefits · Low-risk investing · Tax benefits · Potential U.S. Treasury bond risks · Current Treasury bond rates. Treasury Bill Rates. Treasury Bill Rates. Clear filtersColumnsPrintExport Weekly GOG T-Bills Results · Weekly BOG Bills Results · News Briefs · BOG Oracle. Treasury bills are usually sold in denominations of $ and can reach a maximum denomination of $10 million. T-bill rates depend on interest rate expectations.

Us Crypto Tax Rules

Getting paid in crypto taxes in the USA. The IRS is very clear that when you get paid in crypto, it's viewed as ordinary income. So you'll pay Income Tax. This. Crypto losses must be reported on Form ; you can use the losses to offset your capital gains—a strategy known as tax-loss harvesting—or deduct up to $3, U.S. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and state tax authorities where applicable, and each of. In January , the governing bodies signed the 5th Anti-Money Laundering Directive (5AMLD) into law, marking the first time cryptocurrency providers will fall. In scenarios where profits earned from cryptocurrency are akin to income rather than capital gains, the rules for Income Tax are applied instead. In each of the. The first reason you need to file crypto taxes is that it is the law, and it's always better to stay on the good side of the tax authorities. In the early days. You're required to pay taxes on crypto. The IRS classifies cryptocurrency as property, and cryptocurrency transactions are taxable by law. In scenarios where profits earned from cryptocurrency are akin to income rather than capital gains, the rules for Income Tax are applied instead. In each of the. You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of the. Getting paid in crypto taxes in the USA. The IRS is very clear that when you get paid in crypto, it's viewed as ordinary income. So you'll pay Income Tax. This. Crypto losses must be reported on Form ; you can use the losses to offset your capital gains—a strategy known as tax-loss harvesting—or deduct up to $3, U.S. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and state tax authorities where applicable, and each of. In January , the governing bodies signed the 5th Anti-Money Laundering Directive (5AMLD) into law, marking the first time cryptocurrency providers will fall. In scenarios where profits earned from cryptocurrency are akin to income rather than capital gains, the rules for Income Tax are applied instead. In each of the. The first reason you need to file crypto taxes is that it is the law, and it's always better to stay on the good side of the tax authorities. In the early days. You're required to pay taxes on crypto. The IRS classifies cryptocurrency as property, and cryptocurrency transactions are taxable by law. In scenarios where profits earned from cryptocurrency are akin to income rather than capital gains, the rules for Income Tax are applied instead. In each of the. You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of the.

There are several crypto activities that are tax exempt. Some of these activities include: Purchasing cryptocurrency (including NFTs) using U.S. dollars. A new tax reporting law has entered into force in the U.S. affecting Americans receiving $ or more in crypto. You're required to pay taxes on crypto. The IRS classifies cryptocurrency as property, and cryptocurrency transactions are taxable by law. You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of the. Crypto is treated as property, subject to capital gains and income tax. Short-term gains (held 1 year). In scenarios where profits earned from cryptocurrency are akin to income rather than capital gains, the rules for Income Tax are applied instead. In each of the. The US government has still much to write in terms of tax rules specific to digital assets. For now, one pays taxes on transactions with these assets as one. The IRS treats cryptocurrencies as property, meaning sales are subject to capital gains tax rules. Crypto trading taxes in the US can range from 0% to 37% depending on your overall tax rate and holding period for each crypto you sold, from long-term to short. How is crypto taxed? · Your crypto was stolen or lost. According to current law, these are unfortunately generally not tax-deductible events. · You bought and. In scenarios where profits earned from cryptocurrency are akin to income rather than capital gains, the rules for Income Tax are applied instead. In each of the. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction, and your individual circumstances. For example, you. The principal takeaways of Notice are twofold: (i) Convertible virtual currency is treated as property for federal tax purpose and (ii) the U.S. tax. A new tax reporting law has entered into force in the U.S. affecting Americans receiving $ or more in crypto. Yes. In most jurisdictions around the world, including in the US, UK, Canada, Australia, India, the tax authorities tax cryptocurrency transactions. Most. If you trade or exchange crypto, you may owe tax. Crypto transactions are taxable and you must report your activity on crypto tax forms to figure your tax. The way cryptocurrencies are taxed in the United States mean that investors might still need to pay tax, regardless of if they made an overall profit or loss. U.S. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and state tax authorities where applicable, and each of. Starting in the tax year, all cryptocurrency brokers — including centralized exchanges — operating in the United States will be required to report capital. In , the IRS clarified that staking rewards are considered income upon receipt, which subjects US taxpayers to income tax on crypto received from staking.

Best Incentive Bank Account

Receive up to a $ bonus with required minimum opening deposit (Associated Access Checking: $25, Associated Balanced or Choice Checking: $) and recurring. Here's how to get your bonus · Open. Open a new Chase Business Complete Checking account online or present this offer at your local Chase branch. · Fund. Fund a. The best bank account referral bonus we've seen is offered by Chime®*. You can earn a $ bonus with Chime when a referral opens a new Chime account using your. Banks and credit unions use sign-up bonuses to attract and reward new customers for setting up direct deposits or depositing large sums of money in accounts. CREDIT CARD. 25%. Rewards bonus on eligible Bank of America credit cards ; SAVINGS. 5%. Interest rate booster on a Bank of America Advantage Savings account. Earn a cash bonus in three steps: · Open a new eligible business checking account by December 31, · Deposit $5, or more in New Money* directly into your. Earn up to $ checking account bonus simply by applying online. Choose the checking account right for you and apply today. These bonuses allow you to earn the most with the least amount of work. Most are nationally available, but a few may only be available in certain states. Associated Bank: With a new checking account, you can receive a cash bonus of $, $ or $ if you maintain an average daily balance of $1, to $4, Receive up to a $ bonus with required minimum opening deposit (Associated Access Checking: $25, Associated Balanced or Choice Checking: $) and recurring. Here's how to get your bonus · Open. Open a new Chase Business Complete Checking account online or present this offer at your local Chase branch. · Fund. Fund a. The best bank account referral bonus we've seen is offered by Chime®*. You can earn a $ bonus with Chime when a referral opens a new Chime account using your. Banks and credit unions use sign-up bonuses to attract and reward new customers for setting up direct deposits or depositing large sums of money in accounts. CREDIT CARD. 25%. Rewards bonus on eligible Bank of America credit cards ; SAVINGS. 5%. Interest rate booster on a Bank of America Advantage Savings account. Earn a cash bonus in three steps: · Open a new eligible business checking account by December 31, · Deposit $5, or more in New Money* directly into your. Earn up to $ checking account bonus simply by applying online. Choose the checking account right for you and apply today. These bonuses allow you to earn the most with the least amount of work. Most are nationally available, but a few may only be available in certain states. Associated Bank: With a new checking account, you can receive a cash bonus of $, $ or $ if you maintain an average daily balance of $1, to $4,

What would be a stopper or something to consider? Best checking account bonuses. Chase (Private Client): $3, bonus Citibank: Up to $2, The SoFi bank account currently has the highest APY of any account on our list. Plus, it has one of the highest new customer bank bonus offers: up to $ Earn up to a $ cash bonus when you open a new SoFi Checking and Savings account online with direct deposit. Take advantage of this promotion today! Eastern Bank offers a variety of checking accounts to meet customers' needs. Compare the benefits to determine which account is best for you. SoFi offers up to a $ bonus for any new customer opening a Better Online Bank Account who can put at least $5, of direct deposits into the account within. The bonus reward is calculated as an average of your deposits made to each myRewards Savings account during the previous 11 consecutive months. To be eligible. checking account bonus! At FCU, we work for our members, not stockholders. This means we're dedicated to providing you with the best possible banking. 1. Switching is easy and takes just seven working days · Acorn Account · AIB (NI) · Allica Bank · Allied Irish Bank (GB) · Arbuthnot Latham & Co · Bank of Ireland UK. Our picks at a glance · Axos Rewards Checking.: Best for no overdraft fees · SoFi Checking and Savings.: Best for automated savings tools · Huntington Perks. If your balance is zero we may close your account. Your account must be open, in good standing and must have a balance greater than zero when the cash bonus is. Some of the banks currently offering checking account bonuses include SoFi, Axos, Chase, Citi, Bank of America, and TD Bank. Take advantage of the best checking account bonuses to earn hundreds of dollars by opening a new account. See bonuses from Huntington Bank, Truist. Chase - open a checking and savings account - if you meet the requirements you can get $ (15k new money in savings for 90 days and $ direct deposit into. Open an eligible Fifth Third checking account. Make direct deposits totaling $2, or more within 90 days of account opening to qualify for bonus. The cash. Get up to a $† on a Rewards Checking account when you use promo code RC But hurry – this bonus is limited time only. Simple Steps to Earn Your Checking. Best for highest bonus. Citizens Quest® Checking · Earn up to $ ; Best for variety of bonus accounts. BMO Relationship Checking · Earn $ ; Best for savings. Enjoy up to a $ Bonus · Earning up to a $ cash bonus is easy. · Shared Account Features · Banking built with you in mind. · Good news! A cash bonus promotion. With a Banner Bank checking account, you can enjoy some seriously good benefits. · Earn up to $~ when you open new Personal Accounts. · With all Banner Bank. account online and earn $ with Fifth Third Bank's current checking account bonus offer bonus, your checking account must be open and in good standing. A bonus to the tune of $ Yours to earn with a new TD savings account and qualifying activities. Open in minutes.

Inflation Gold Prices

Gold prices might go up when asset holders flock to the precious metal and thus drive up demand amid fears of inflation going up. But while you might see the. The price of gold is influenced by a variety of global factors, not just the inflation rate in a specific country. While it's true that gold is. Gold increased USD/t oz. or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark market. Indeed, gold prices were increasing in the 70s, when the inflation rate was high and accelerating, while they were decreasing in the 80s and the 90s, when the. Following the pandemic's peak, gold prices fell to a trading range between $1, and $1, before breaking out in late to new highs of around $2, It. The Price of Gold, - Present. · London Market Price for the years to Present · Gold/Silver Price Ratio for the years to Present · New York Market. The week gold price high is $2,, while the week gold price low is $2, FEATURED PARTNER OFFER. Gold Price in US Dollars is at a current level of , up from the previous market day and up from one year ago. This is a change of %. In comparison, the value of gold has largely been on an upward trajectory in the last century. While it fluctuates some over time, like any other commodity, an. Gold prices might go up when asset holders flock to the precious metal and thus drive up demand amid fears of inflation going up. But while you might see the. The price of gold is influenced by a variety of global factors, not just the inflation rate in a specific country. While it's true that gold is. Gold increased USD/t oz. or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark market. Indeed, gold prices were increasing in the 70s, when the inflation rate was high and accelerating, while they were decreasing in the 80s and the 90s, when the. Following the pandemic's peak, gold prices fell to a trading range between $1, and $1, before breaking out in late to new highs of around $2, It. The Price of Gold, - Present. · London Market Price for the years to Present · Gold/Silver Price Ratio for the years to Present · New York Market. The week gold price high is $2,, while the week gold price low is $2, FEATURED PARTNER OFFER. Gold Price in US Dollars is at a current level of , up from the previous market day and up from one year ago. This is a change of %. In comparison, the value of gold has largely been on an upward trajectory in the last century. While it fluctuates some over time, like any other commodity, an.

For protection against inflation, demand for gold rises, providing support for gold prices. Real interest rate (i.e., nominal rate less inflation) also weighs. Gold Price in US Dollars is at a current level of , up from the previous market day and up from one year ago. This is a change of. Like other commodities, gold prices can be quite volatile. But gold tends to move for different reasons than primarily industrial commodities, such as copper. Gold Prices - Year Historical Chart. Interactive chart of historical data for real (inflation-adjusted) gold prices per ounce back to Urjit Patel discusses the evolution of India's inflation, and argues that if gold prices stay elevated or increase going forward, and wealth effects. The price of gold is generally inversely related to the value of the US dollar because the metal is dollar-denominated. Gold price. Gold prices (US$ per troy ounce), in nominal US$ and inflation adjusted US$ from onward. Price of gold – Gold price history in –. Gold typically outperforms equities during a recession and sees elevated prices during periods of inflation. Gold prices rose 9% in March and April during a. Despite the importance of money supply on the rate of inflation and the price of gold, we argue that an increasing amount of money in an economy leads to an. The results indicated that expected inflation affects interest rates but does not affect gold prices. The theoretical literature suggests a positive. Like the value of any asset, gold prices are influenced by market uncertainty. During the pandemic, investors shored up gold investments in bullion, stocks and. Urjit Patel discusses the evolution of India's inflation, and argues that if gold prices stay elevated or increase going forward, and wealth effects. Inflation can affect gold prices in a few ways. Firstly, as inflation increases, the value of the currency decreases, which can make gold more attractive as. Gold has demonstrated an average annual rate of return of approximately % over the long term. This number is achieved by looking at gold's prices from During periods of high inflation, people often flock to gold and silver which results in driving up demand and prices. Alternatively, in times of low inflation. Gold is often seen as an inflation hedge which protects investors against the loss of purchasing power. In this context, the nominal price of gold is often. edit2: dollars are worth $ today. So the g/$ is more like g/$ if we're adjusting for inflation. This still leaves us with an. The Russia-Ukraine war, US Fed rate increase, and inflation have played a role in gold rates increasing. The increase in the demand for gold has seen the. Is the gold price a hedge against inflation? The gold price is considered a hedge against inflation, as many traders and investors opt to get exposure to it to. Interest rates go up, gold prices go down! · When central banks announce a rise in interest rates, the price of gold generally falls. There are two reasons for.

Ripplenet Blockchain

Ripple (XRP) is a crypto asset that uses RippleNet, an international remittance solution for financial institutions created by Ripple, a technology company. RippleNet enables faster, lower-cost payments across 45 countries and six continents. Read our one-pager to understand how the #blockchain. The XRP Ledger (XRPL) is a decentralized, public blockchain led by a global community of businesses and developers looking to solve problems and create value. It was created to solve a major point of friction in international payments, pre-funding of nostro/vostro accounts. Banks can use XRP to source liquidity in. We have established that XRP and Ripple are not interchangeable. XRP is a digital asset while Ripple refers to a company that created the Ripple Consensus. Some customers, in addition to deploying Ripple's “blockchain” solution (RippleNet), leverage a digital asset known as XRP. Just as Bitcoin is the native. Ripple is a real-time gross settlement system, currency exchange and remittance network that is open to financial institutions worldwide and was created by. cryptocurrencies, primarily through its RippleNet network and the XRP Ledger. The XRP Ledger is a decentralized blockchain technology that supports the Ripple. Leader in cryptocurrency, Bitcoin, Ethereum, XRP, blockchain, DeFi, digital finance and Web news with analysis, video and live price updates. Ripple (XRP) is a crypto asset that uses RippleNet, an international remittance solution for financial institutions created by Ripple, a technology company. RippleNet enables faster, lower-cost payments across 45 countries and six continents. Read our one-pager to understand how the #blockchain. The XRP Ledger (XRPL) is a decentralized, public blockchain led by a global community of businesses and developers looking to solve problems and create value. It was created to solve a major point of friction in international payments, pre-funding of nostro/vostro accounts. Banks can use XRP to source liquidity in. We have established that XRP and Ripple are not interchangeable. XRP is a digital asset while Ripple refers to a company that created the Ripple Consensus. Some customers, in addition to deploying Ripple's “blockchain” solution (RippleNet), leverage a digital asset known as XRP. Just as Bitcoin is the native. Ripple is a real-time gross settlement system, currency exchange and remittance network that is open to financial institutions worldwide and was created by. cryptocurrencies, primarily through its RippleNet network and the XRP Ledger. The XRP Ledger is a decentralized blockchain technology that supports the Ripple. Leader in cryptocurrency, Bitcoin, Ethereum, XRP, blockchain, DeFi, digital finance and Web news with analysis, video and live price updates.

Ripple Net is mainly used for international money transfers. Thanks to blockchain technology, value transfers can be tracked and traced to. Main Description: RippleNet is a global network of financial institutions and payment providers that leverages blockchain technology to facilitate seamless. Ripple connects banks, payment providers, digital asset exchanges and corporates via RippleNet. blockchain companies, blockchain products and blockchain. Despite Ripple's efforts to partner with financial institutions worldwide, many banks struggle to integrate RippleNet's APIs seamlessly. This. Ripple (XRP) price, live charts, news and more. Ripple to USD price is updated in real time. Learn about Ripple, receive market updates and more. Ripple's RippleNet payments network utilizes the XRP Ledger blockchain to The XRP cryptocurrency that is native to the XRP Ledger is used as a. The XRP digital currency gets around the trust issue. XRP is a digital currency that was launched in You can send XRP to any Ripple wallet address on the. Ripple Labs, Inc. is an American technology company which develops the Ripple payment protocol and exchange network. Originally named Opencoin and renamed. DeeMoney offers blockchain cross-border payments with RippleNet. The fintech becomes Thailand's first non-bank institution to use the solution. 20th March RippleNet is a blockchain-based application that allows for making an international money transfer between banks. It will be possible to transfer money from the. Real-time currency exchange and remittance network Ripple has teamed up with Finastra to allow banking customers to access RippleNet, its worldwide blockchain. RippleNet is a global network of financial institutions and payment providers that leverages blockchain technology to facilitate seamless cross-border. DeeMoney offers blockchain cross-border payments with RippleNet. The fintech becomes Thailand's first non-bank institution to use the solution. 20th March. Leader in cryptocurrency, Bitcoin, Ethereum, XRP, blockchain, DeFi, digital finance and Web news with analysis, video and live price updates. Ripple is a leading provider of enterprise blockchain and cryptocurrency solutions for payments. RippleNet is Ripple's global blockchain payment network. Ripple's XRP Ledger blockchain is used to settle cross-border payments on Ripple's RippleNet in a fraction of the time, and at a fraction of the cost, that. Using blockchain technology, Ripple allows financial institutions to process payments instantly, reliably, cost-effectively, and with end-to-end visibility. Ripple and its cryptocurrency token, XRP, is one of the leading payment cryptocurrencies and among the top 10 cryptocurrencies by market capitalization. · Using. Products & Services. RippleNet. Ripple's XRP Ledger blockchain is used to settle cross-border payments on Ripple's RippleNet in a fraction of the time, and at.

What To Invest Against Inflation

Beyond home ownership, real estate investments can be made through REITs (also known as Real Estate Investment Trusts) or through mutual funds that invest in. Investment Risk Management Tips During an Inflation · Diversify Your Investment Portfolio · Regularly Monitor Critical Economic Indicators · Practice Hedging. 1. TIPS. TIPS stands for Treasury Inflation-Protected Securities. · 2. Cash · 3. Short-term bonds · 4. Stocks · 5. Real estate · 6. Gold · 7. Commodities · Bottom line. How can I protect myself and my assets against inflation? · Re-evaluate your purchasing habits. · Don't hold too much cash. · Invest in assets that appreciate in. The claim that real estate is a good hedge against inflation appears reasonable on theoretical grounds. All other things being equal, during periods of. 6. Consider property Investing in property can be a good way to beat inflation and diversify your investment portfolio. House prices have tended to rise well. Energy, equity REITs,1 and financials are some of the equity sectors that could stand to benefit in an inflationary environment. Here's what you need to know about inflation today, the recession it could possibly be helping to usher in in the US, and the 8 best investments for inflation. Some examples include: Gold, stocks, commodies, real estate and inflation links-bonds. In Europe, you have some inflation-linked bonds ETFa like. Beyond home ownership, real estate investments can be made through REITs (also known as Real Estate Investment Trusts) or through mutual funds that invest in. Investment Risk Management Tips During an Inflation · Diversify Your Investment Portfolio · Regularly Monitor Critical Economic Indicators · Practice Hedging. 1. TIPS. TIPS stands for Treasury Inflation-Protected Securities. · 2. Cash · 3. Short-term bonds · 4. Stocks · 5. Real estate · 6. Gold · 7. Commodities · Bottom line. How can I protect myself and my assets against inflation? · Re-evaluate your purchasing habits. · Don't hold too much cash. · Invest in assets that appreciate in. The claim that real estate is a good hedge against inflation appears reasonable on theoretical grounds. All other things being equal, during periods of. 6. Consider property Investing in property can be a good way to beat inflation and diversify your investment portfolio. House prices have tended to rise well. Energy, equity REITs,1 and financials are some of the equity sectors that could stand to benefit in an inflationary environment. Here's what you need to know about inflation today, the recession it could possibly be helping to usher in in the US, and the 8 best investments for inflation. Some examples include: Gold, stocks, commodies, real estate and inflation links-bonds. In Europe, you have some inflation-linked bonds ETFa like.

Value stocks. Some research has shown that value stocks tend to do better than growth stocks during periods of inflation. Value stocks are companies that have. We sell TIPS for a term of 5, 10, or 30 years. As the name implies, TIPS are set up to protect you against inflation. If available, when choosing an Inflation Bond look for a duration that aligned with your investment horizon to match the inflation hedge (or short duration for. However, the inflation tail should never wag the investment dog. If you have specific goals or timetables for your investment plan, don't swerve from them. As. By investing in equity funds, you can benefit from the capital growth of the underlying companies, as well as any dividend income. Equal-weight and capped ETFs, such as the newly launched iShares S&P 3% Capped Index ETF (TSX: XUSC) and Canadian-hedged iShares S&P 3% Capped Index ETF. One excellent inflation investment strategy that you can take advantage of in is to invest in I Bonds. These U.S. savings bonds earn interest based on a. We believe real estate is the best hedge against inflation. Owning real estate does more than protect your wealth—it can actually make you money. For example. For many investors, inflation-protected bonds – specifically designed to hedge against The dollar you invest today will be less valuable tomorrow. To stay ahead of inflation, look at your investment mix as a whole and evaluate where you stand. There are no silver bullets—you may need a combination of. 1. I Bonds · 2. REITs · 3. Commodities · 4. Look for stocks with pricing power · 5. Savings, CDs, and money market accounts · 6. Focus on things people need · 7. Fine Wine: The Best Hedge Against Inflation Inflation reduces the value of your money and investments over time. Trust fine wine to protect the value of your. REITs provide natural protection against inflation. Real estate rents and values tend to increase when prices do. This supports REIT dividend growth. However, while gold tends to perform well during inflationary periods, the rise of inflation-protected securities (e.g., TIPS), cryptocurrencies, and other. For new investors or those who favour a hands-off approach, one of the best ways to diversify is with an investment fund. These hold shares in many firms. However, while gold tends to perform well during inflationary periods, the rise of inflation-protected securities (e.g., TIPS), cryptocurrencies, and other. Having a well diversified portfolio with an asset allocation based on risk tolerance is the best defence against inflation. In most cases, inflation will be a. Private alternative investments offer unique advantages that can help mitigate the impact of inflation on an investor's portfolio. Self Storage Real Estate is a Great Inflation Hedge. While stocks, bonds, and cash lose their purchasing power as inflation rises, investing in self-storage.

Best Coax Cable For Spectrum Internet

A quick word on cable. Spectrum Internet relies mainly on hybrid fiber-coaxial cable connections to provide service to subscribers' homes. As you can tell by. The Spectrum self-installation kit contains the following: · A handy guide with pictures · A Spectrum internet modem · A Spectrum Wi-Fi router · Two coaxial cables. RG11 is highly recommended for coaxial cables that exceeds over ft. This combination is highly recommended and fully approved for use with most satellite and. Spectrum Internet Gig is our ultimate Internet choice. Power all your devices with speeds up to 1 Gbps with no data caps, contracts, taxes or hidden fees. Re: Affordable Low-loss Coax cable type for outdoor antenna! LMR is your best bet there. With cabling you get what you pay for really, usually at least. In. The Charter Spectrum network is what's known as a “hybrid fiber-coaxial” (HFC) system. This refers to the type of cable used in the network. The connection to. Hitron's CODA DOCSIS Cable Modem is available on Amazon. Hitron's CODA cable modem has DOCSIS to deliver the fastest Multi-Gigabit speeds to your. Foot (18 Inch) White - Solid Copper Coax Cable - RG6 Coaxial Cable with Connectors, F81 / RF, Digital Coax for Audio/Video, Cable TV, Antenna, Internet. If you need to connect a modem and receiver to the same cable outlet, use the splitter and additional coaxial cable that's included in your self-install kit. A quick word on cable. Spectrum Internet relies mainly on hybrid fiber-coaxial cable connections to provide service to subscribers' homes. As you can tell by. The Spectrum self-installation kit contains the following: · A handy guide with pictures · A Spectrum internet modem · A Spectrum Wi-Fi router · Two coaxial cables. RG11 is highly recommended for coaxial cables that exceeds over ft. This combination is highly recommended and fully approved for use with most satellite and. Spectrum Internet Gig is our ultimate Internet choice. Power all your devices with speeds up to 1 Gbps with no data caps, contracts, taxes or hidden fees. Re: Affordable Low-loss Coax cable type for outdoor antenna! LMR is your best bet there. With cabling you get what you pay for really, usually at least. In. The Charter Spectrum network is what's known as a “hybrid fiber-coaxial” (HFC) system. This refers to the type of cable used in the network. The connection to. Hitron's CODA DOCSIS Cable Modem is available on Amazon. Hitron's CODA cable modem has DOCSIS to deliver the fastest Multi-Gigabit speeds to your. Foot (18 Inch) White - Solid Copper Coax Cable - RG6 Coaxial Cable with Connectors, F81 / RF, Digital Coax for Audio/Video, Cable TV, Antenna, Internet. If you need to connect a modem and receiver to the same cable outlet, use the splitter and additional coaxial cable that's included in your self-install kit.

The easiest way to test your coax cable outlet signal is by using a coax cable testing tool that is built specifically for the task. That's basically what I did with my internet connection for my modem. They have the same types of cables. The connectors are fairly cheap a couple of bucks at. The following modems and gateways meet our service and performance requirements and are certified for use with all Cox Internet packages. Best Speeds. Xfinity. Best speed ratings according to our Customer Satisfaction Survey; Data caps; Speeds: –1, Mbps · Most Flexible. Spectrum. No contracts. We'll walk you through the process self-installing Spectrum service. We'll also talk about equipment and whether to rent from Spectrum or buy your own. Can I use the Dream Machine Pro with AT&T Fiber or Spectrum Internet without using their provided Router? : The cable modem converts coax to ethernet. Spectrum ranked evenly with Xfinity, the other largest U.S. cable provider. Spectrum gained points for factors including broad availability, fast speeds and no-. To get the best WiFi coverage, place the router in a central location in your home. Connect one end of the Spectrum receiver's coax cable to one of the (OUT). Loading Recommendations · Zenith. 6 ft. RG6 Coaxial Cable, Black · Philips. 25 ft. RG6 Dual Shield Coaxial Cable with F-Type Connectors in. Cable Modem and TV amplifiers are designed to boost signals coming from Cable TV/Internet Service Provider. The Best Choice for Students. View student Internet plans. A couple Is 5G Home Internet faster than Spectrum cable Internet? Cable Internet from. Spectrum Internet is powered by a fiber-rich broadband network, which is a hybrid of fiber and coaxial cable, and it can deliver download speeds up to 1 Gbps. Connect one end of your coax cable to your Modem and the other end to your cable outlet. best Internet, TV, and Smart Home technologies. We help you. We are your one-stop shop for all your coaxial cable component needs. Our coaxial cable options include 50 Ohm braided, flexible and super-flexible foam. GE RG6 Coaxial Cable, 25 ft. F-Type Connectors, Double Shielded Coax, Input Output, Low Loss Coax, Ideal for TV Antenna, DVR, VCR, Satellite Receiver, Cable Box. While there are several different ways to test your coax cables and outlets, testing your coax outlets and cable wiring for a valid signal from your Cable. CommScope offers an extensive range of coaxial cables, meticulously designed for various applications. We are the coaxial cable supplier you need for reliable. Spectrum's cable connection is better for gaming than Frontier's DSL connection. Frontier does have fiber, though its service remains limited. Frontier's fiber. Outer plastic sheath; Woven copper shield; Inner dielectric insulator; Copper core. Coaxial cable is a type of transmission line, used to carry high-. BEST SELLERS. In Coaxial RF (F-Type) Cables Had some dropouts and picture tearing on 4K TV. First suggestion was to upgrade cables. I did and this reduced the.

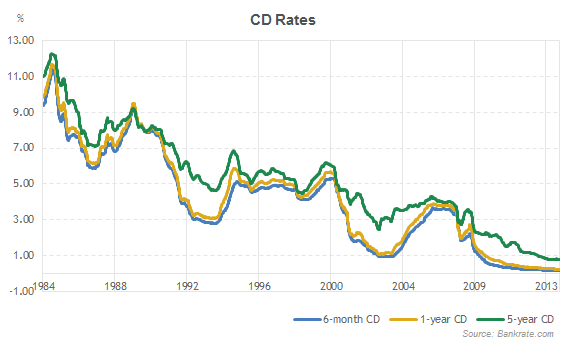

Who Has The Highest Cd Interest Rates

Navy Federal Credit Union is the world's largest credit union with 13 million members. In addition to CDs, Navy Federal also offers checking and savings. with a Certificate of Deposit (CD) Meet your savings goal or build up your emergency funds faster with accounts that typically offer higher interests rates. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from INOVA Federal Credit Union for a 5-month term. What is the best 5-year CD rate? For high rates on 5-year CDs, check out: First Internet Bank, M.Y. Safra Bank, and Marcus by Goldman Sachs. Deposit at least $ within 10 days of opening your CD to receive the highest published interest rate and Annual Percentage Yield (APY) we offer for your CD's. Certificates of deposit accounts typically earn better interest than savings accounts, especially when you choose CDs with the longest terms, such as 60 months. The highest 1-month CD rate today is % from Merchants Bank of Indiana. Best 3-month CD rates. The highest 3. CDs offer our most competitive, promotional rates - and great returns. Choose the term length that works best for you. The rate is guaranteed for the full. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. Navy Federal Credit Union is the world's largest credit union with 13 million members. In addition to CDs, Navy Federal also offers checking and savings. with a Certificate of Deposit (CD) Meet your savings goal or build up your emergency funds faster with accounts that typically offer higher interests rates. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from INOVA Federal Credit Union for a 5-month term. What is the best 5-year CD rate? For high rates on 5-year CDs, check out: First Internet Bank, M.Y. Safra Bank, and Marcus by Goldman Sachs. Deposit at least $ within 10 days of opening your CD to receive the highest published interest rate and Annual Percentage Yield (APY) we offer for your CD's. Certificates of deposit accounts typically earn better interest than savings accounts, especially when you choose CDs with the longest terms, such as 60 months. The highest 1-month CD rate today is % from Merchants Bank of Indiana. Best 3-month CD rates. The highest 3. CDs offer our most competitive, promotional rates - and great returns. Choose the term length that works best for you. The rate is guaranteed for the full. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options.

CD Valet is compensated by a limited number of financial institutions that indo877.site: No Limit. Open Now. Bask Bank, Member. Lock in a fixed rate with an online-only certificate of deposit with month and 8-month CDs at Citizens. View online CD rates and open an account today. If interest rates fall, the interest earned from the existing CDs would likely be higher than market interest rates. CD and contacting you with the highest. offers, interest rate increases on our 6, 12 and 18 month CDs. Get You earn a fixed interest rate that's typically higher than the rates offered on standard. The best CD rates of are as high as % APY. The highest rate is offered by CommunityWide Federal Credit Union on a 6-month certificate. The best CDs currently range from % to % — with some promo rates as high as % — which is higher than average compared with the last 15 years. But as. rate is what you're looking for, a Superior CD is Find Out More About CD Interest Rates in Toledo and Cincinnati, OH Today. Generate interest at higher rates. rate which is a short-term interest rate benchmark. Recent Changes in Credit union CD rates can at times be higher than bank CD rates, and online. Compare CD Accounts on Raisin ; Dayspring Bank · % ; Prism Bank · % ; Ponce Bank · % ; Sterling Federal Bank · % ; Ponce Bank · %. I have the majority of my CDs at Marcus GS and have used them for years. I just purchased my first brokerage CD at Vanguard don't really like. The best 6-month CDs are offering interest rates around 5%. Six-month CDs are best for those who are looking for elevated rates on their savings for short-term. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. Annual Percentage Yield (APY) accurate as of 08/26/ $ minimum deposit required to open a CD with a term of 3 months or more; $5, minimum. A CD is a secure way to grow your savings with a higher interest rate than a regular savings account. At TowneBank, a personal banker can assist you in choosing. Short-Term CDs. Short-term savings at a higher interest rate. Terms from seven days to six months ; Tiered Long-Term CDs. Get higher interest rates with several. CDs: A Great Way to Save · Certificates of Deposit (CDs) keep your money safe long term with higher interest than most Money Market and Savings accounts. rate which is a short-term interest rate benchmark. Recent Changes in Credit union CD rates can at times be higher than bank CD rates, and online. A certificate of deposit (CD) can allow you to enjoy higher fixed interest rates while still having all the security of an FDIC-insured2 savings account. $ minimum balance. Maximum deposit is $10,, Funds currently deposited in accounts at Flagstar Bank are not eligible for the promotional interest rate. Who has the highest CD rates today? · 1-Year. Charles Schwab Bank CD, % · 2-Year. CFG Bank CD, % · 3-Year.