indo877.site Learn

Learn

Best Play To Earn Blockchain Games

Discover the best play and earn blockchain games and NFT games with indo877.site image__png. 2. CryptoPop The next Android crypto game on our list is CryptoPop. The main premise of the game is to group together crypto coins and earn as many points as. Top Play-to-Earn Crypto Games · 1. Big Time · 2. Axie Infinity · 3. The Sandbox · 4. Decentraland · 5. Splinterlands · 6. Illuvium · 7. Revv Racing · 8. Battle of. MemeFi Coin is an idle game where players fight ghost enemies and collect coin rewards. It merges traditional gaming elements with crypto. Top Play-to-Earn Crypto Games · 1. Big Time · 2. Axie Infinity · 3. The Sandbox · 4. Decentraland · 5. Splinterlands · 6. Illuvium · 7. Revv Racing · 8. Battle. crypto games crypto games is the best source to find Play-To-Earn Crypto & NFT Blockchain Games. Earn Cryptocurrency & NFTs playing Ethereum & Bitcoin Games. For a real Inception moment, you can also play in-game play to earn crypto games within Decentraland. Some of the most popular are Ethermon and WonderQuest. Powchess is a free-to-play game that allows players to earn BSV and real money through PvP chess games and tournaments. The game includes microtransactions and. I was in dozens of crypto games. Soooo many failed. Soooo many pumped. Defi Kingdoms, Defira, Mars Colony, Enders Gate, Shibaki Card Game. Discover the best play and earn blockchain games and NFT games with indo877.site image__png. 2. CryptoPop The next Android crypto game on our list is CryptoPop. The main premise of the game is to group together crypto coins and earn as many points as. Top Play-to-Earn Crypto Games · 1. Big Time · 2. Axie Infinity · 3. The Sandbox · 4. Decentraland · 5. Splinterlands · 6. Illuvium · 7. Revv Racing · 8. Battle of. MemeFi Coin is an idle game where players fight ghost enemies and collect coin rewards. It merges traditional gaming elements with crypto. Top Play-to-Earn Crypto Games · 1. Big Time · 2. Axie Infinity · 3. The Sandbox · 4. Decentraland · 5. Splinterlands · 6. Illuvium · 7. Revv Racing · 8. Battle. crypto games crypto games is the best source to find Play-To-Earn Crypto & NFT Blockchain Games. Earn Cryptocurrency & NFTs playing Ethereum & Bitcoin Games. For a real Inception moment, you can also play in-game play to earn crypto games within Decentraland. Some of the most popular are Ethermon and WonderQuest. Powchess is a free-to-play game that allows players to earn BSV and real money through PvP chess games and tournaments. The game includes microtransactions and. I was in dozens of crypto games. Soooo many failed. Soooo many pumped. Defi Kingdoms, Defira, Mars Colony, Enders Gate, Shibaki Card Game.

Powchess is a free-to-play game that allows players to earn BSV and real money through PvP chess games and tournaments. The game includes microtransactions and. Move To Earn games will continue to stay hot through and The crypto gaming industry has seen significant growth with the rise of M2E trend. Some of. How do play-to-earn crypto games work? · What are the best play-to-earn games? · Axie Infinity · Gods Unchained · Mines of Dalarnia · My Neighbour Alice · The Sandbox. 1. Pancake ProtectorsAn immersive tower defense game! ; 2. Axie InfinityBattle, collect and build with Axies! ; 3. Karate CombatFirst fan-controlled real world. Discover the best play and earn blockchain games and NFT games with indo877.site Constantly updated. Stepn is the only game I know of that makes money. You can earn 10$ a day walking (was 30) a few weeks ago with an upfront investment of $. Play To Earn Games: Discover top Play-to-Earn games for Earn crypto and NFTs while you play. Explore the best blockchain games and start gaming for. Browse Free-To-Play Games · Age of Dino · Paravox · Confiction Labs: Riftstorm · Yaku · Voxie Tactics · Undead Blocks · The Treeverse. What Games Can I Play to Earn Cryptocurrency? Some of the best NFT games, for example, slots, table games, and many more which you can play to gain profits. Gods Unchained is one of the most popular play-to-earn tactical card games on the blockchain, which has 52 million worth of cards already being exchanged by the. indo877.site helps you find the next big NFT-powered, blockchain games to play & invest. Find hidden gems in crypto gaming market. From Axie Infinity to CryptoBlades, here is a list of top play-to-earn blockchain games that offer users a rich gaming experience along with multiple. Here is a list of the most notable play-to-earn games you should know about. Axie Infinity (AXS). Axie Infinity is a game that is reminiscent of the highly. Your journey into the ether space begins here! The next iteration in crypto earning games has arrived, this time with an Ethereum theme! Check out our carefully curated list of the best play-to-earn crypto games in Dive into the world of P2E and explore the exciting potential of blockchain. PlayToEarn is the best source to find Play-To-Earn Crypto & NFT Blockchain Games. Earn Crypto & Non-Fungible-Tokens while playing Ethereum & Bitcoin Games. Genre: Play To Earn Games · Hooked Protocol - Game Review · LaRace - Game Review · Evermoon: The Web3 MOBA Revolution - Game Review · DeepSpace: Space Metaverse. mines games online is the best source to find Play-To-Earn Crypto & NFT Blockchain Games. Earn Cryptocurrency & NFTs playing Ethereum & Bitcoin Games. To help. Top 5 Trending Play-to-Earn Games: Unlocking the Future of Gaming and Earning blockchain games and stay up-to-date. Subscribe. PlayToEarn. Discover. Top. One of the most popular Play-to-Earn games, Axie Infinity allows players to breed, train, and battle Axies—digital pets represented as NFTs. Players earn AXS.

Acron Fertilizer

Another Acron's fertilizer brand, NP SO3 has demonstrated the best performance in yielding durum wheat of the highest quality. With. Global mineral fertilizer company Acron Group has turned to Qlik to support its #digital transformation. See more on how they are providing. Complex fertilisers contain two or three essential nutrients (nitrogen, phosphorus, potassium) in various ratios. Sector comparison Acron Fertilizer (Basic Materials) - Sector performance indo877.site In order to strengthen its position in the world's largest fertiliser market – China – in the Group acquired complex fertiliser producer Hongri Acron and. Russian fertilizer maker Acron has offered billion zlotys ($ million) to buy up to 66% of Polish chemicals company Azoty Tarnow and expand its. Acron is a vertically integrated chemical company that produces mineral fertilizers. The company offers ammonium nitrate, urea, apatite concentrate, methanol. Acron is one of the leading global mineral fertiliser producers. The Groups key business segments include ammonia, nitrogen and complex mineral fertilisers. We have three locations (Edelstein, Brimfield, Cramer) to service you with the following products: Phosphorus fertilizers (DAP); Potash; Urea; Ammonium Sulfate. Another Acron's fertilizer brand, NP SO3 has demonstrated the best performance in yielding durum wheat of the highest quality. With. Global mineral fertilizer company Acron Group has turned to Qlik to support its #digital transformation. See more on how they are providing. Complex fertilisers contain two or three essential nutrients (nitrogen, phosphorus, potassium) in various ratios. Sector comparison Acron Fertilizer (Basic Materials) - Sector performance indo877.site In order to strengthen its position in the world's largest fertiliser market – China – in the Group acquired complex fertiliser producer Hongri Acron and. Russian fertilizer maker Acron has offered billion zlotys ($ million) to buy up to 66% of Polish chemicals company Azoty Tarnow and expand its. Acron is a vertically integrated chemical company that produces mineral fertilizers. The company offers ammonium nitrate, urea, apatite concentrate, methanol. Acron is one of the leading global mineral fertiliser producers. The Groups key business segments include ammonia, nitrogen and complex mineral fertilisers. We have three locations (Edelstein, Brimfield, Cramer) to service you with the following products: Phosphorus fertilizers (DAP); Potash; Urea; Ammonium Sulfate.

Acron PJSC is a Russian fertilizer producer and distributer to the agricultural industry globally. The company's segments are organized based on activity. PJSC Acron specializes in production and marketing of chemical fertilizers. The group's activity is organised arround 5 families of products. Acron Group is a leading Russian and global mineral fertiliser producer with a diversified product portfolio consisting of multi-nutrient fertilisers such as. MOSCOW, April /TASS/. Acron, a global mineral fertilizer producer, reported a % increase in commercial products output for the first quarter of Acron PJSC is a vertically integrated Russian mineral fertilizer producer. The Company offers a diversified product portfolio consisting of multi-nutrient. Acron is a major global mineral fertiliser producer. Acron Group · Leading Russian vertically integrated NPK producer, among the top ten global producers by. Complex fertilisers contain two or three essential nutrients (nitrogen, phosphorus, potassium) in various ratios. fertilizer production, and the creation of a unique, innovative rare earth ele- ments program in Russia. A recent mile- stone was the launch of the. Bolsonaro pushes for mining on indigenous lands to reduce Russia fertilizer dependence. The move is seen as an attempt by the Brazilian leader to take. Acron Group's subsidiary introduces innovative agricultural solutions amid environmental sustainability efforts. April 25, pm · 1 min read. OAO Acron, a Russian nitrogen fertilizer producer, plans to produce its own phosphates within a year as it seeks to boost self-sufficiency in raw materials. Acron Group is a leading Russian and global mineral fertiliser producer with a diversified product portfolio consisting of multi-nutrient fertilisers. Acron Group, a leading mineral fertiliser producer in Russia and globally, has developed several new brands of NPK complex mineral fertilisers at its Veliky. Association, Russian Fertilizer Producers beneficial cooperation, superior results: Acron's complex fertilisers help Chinese farmers earn more money! Acron PJSC is a vertically integrated Russian mineral fertilizer producer. The Company offers a diversified product portfolio consisting of multi-nutrient. - Russia's Acron, one of Europe's top 10 mineral fertilizer makers, has agreed $ billion of equity and debt financing for a potash project in. Headquartered in Moscow, Russia, and founded in , Acron is a global producer of mineral fertilizer. Their products include complex and nitrogen fertilizers. Acron Group is a Russian mineral fertiliser producer with a diversified product portfolio consisting of multi-nutrient fertilisers such as NPK and bulk. Current Fertilizer Prices updated 8/29/ All bids are 10 minute delayed and are subject to verification by Akron Services, Inc. Any product pricing is.

Best Online Debt Consolidation Loan

If the loan balances on your high-interest debts are within your reach to pay, this can be a good strategy. Or, start your loan application online now. Tools. If you're juggling multiple credit cards and/or loans, consolidating them could save you money — and time. Use our debt consolidation calculator to see how you. Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for Fair Credit: Avant. A Discover personal loan is an excellent choice for debt consolidation (as long as you aren't using it to pay off your loan balance on a Discover credit. Achieve has three solutions for debt consolidation: personal loans, home equity loans and debt resolution. See which one is best for you by taking a quick. Debt Consolidation Loan Lenders ; NASA Federal Credit Union, Repayment terms, $1, to $30,, 0 to 84 months, % to % ; Citibank, Big bank, $2, to. Pay off your credit card debt with a debt consolidation loan. Find great rates to pay less in interest and minimize monthly bills into a single payment. Compare options to consolidate your debt and find the best debt consolidation loan in Canada Getting an online debt consolidation loan follows the. SoFi: Best for fast funding. · Upgrade: Best for poor or thin credit. · Achieve: Best for quick approval decisions. · LendingClub: Best for co-borrowers. · Discover. If the loan balances on your high-interest debts are within your reach to pay, this can be a good strategy. Or, start your loan application online now. Tools. If you're juggling multiple credit cards and/or loans, consolidating them could save you money — and time. Use our debt consolidation calculator to see how you. Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for Fair Credit: Avant. A Discover personal loan is an excellent choice for debt consolidation (as long as you aren't using it to pay off your loan balance on a Discover credit. Achieve has three solutions for debt consolidation: personal loans, home equity loans and debt resolution. See which one is best for you by taking a quick. Debt Consolidation Loan Lenders ; NASA Federal Credit Union, Repayment terms, $1, to $30,, 0 to 84 months, % to % ; Citibank, Big bank, $2, to. Pay off your credit card debt with a debt consolidation loan. Find great rates to pay less in interest and minimize monthly bills into a single payment. Compare options to consolidate your debt and find the best debt consolidation loan in Canada Getting an online debt consolidation loan follows the. SoFi: Best for fast funding. · Upgrade: Best for poor or thin credit. · Achieve: Best for quick approval decisions. · LendingClub: Best for co-borrowers. · Discover.

Look to see if one is available to you with a lower interest rate. Consolidating your debt. If you have multiple loans or credit cards, you. Check your personalized rates · Filter results · LightStream: Best for high-dollar loans and longer repayment terms · Upstart: Best for little credit history. Enter information for all existing loans and debts that you intend to consolidate into one loan/debt. Best Credit Cards for Bad Credit (or No Credit). A debt consolidation loan is a form of debt refinancing that combines multiple balances from credit cards and other high-interest loans into a single loan. Reach Financial: Best for quick funding. Reach Financial logo · 14 · % - % · Free monthly credit score ; Upstart: Best for borrowers with bad credit. Combine multiple existing loans into one simple monthly payment that you can make online. Top debt consolidation loan FAQs. In what currency does UNFCU lend? Personal Loans for Debt Consolidation · Debt Consolidation · Lower your interest paid which may reduce your debt faster · A loan that's simple, easy and convenient. You can consolidate your credit card debt, overdue bills, store financing, and more. Women completing an instant quote online. Personal Loans for Debt Consolidation A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired. Debt Consolidation Loans for Bad Credit in September ; Upstart logo · · % - % · 36 or 60 months · $1, to $50, ; prosper logo · · % -. Quickly lower your monthly payments & simplify your bills by comparing debt consolidation loans from top lenders. Find your best rate & apply online today! A debt consolidation loan is where you apply for a personal loan with the best debt consolidation contender and can lead you even deeper into debt. LightStream is a solid option for good-credit borrowers, with no fees and low rates that vary based on loan purpose. Qualifications: Minimum credit score: Best Debt Consolidation Loans of September · Best Lenders for Debt Consolidation · SoFi · LightStream · PenFed Credit Union · Avant · Prosper · Discover · First. Upstart: Best for borrowers with bad credit Ratings and reviews are from real consumers who have used the lending partner's services. Ratings and reviews. When determining the best debt consolidation loan for you, look beyond the APRs. While the interest rate is often the deciding factor, you should also pay. Best Debt Consolidation Loans for Bad Credit (September ) · LendingPoint image Winner: LendingPoint · Splash Financial image Large Loan Amounts: Splash. A debt consolidation loan from Best Egg offers a fixed rate and flexible terms to help you combine and pay off high-interest debt faster. Apply online. A debt consolidation loan is cash you can access that is used to pay off all your debt from previous loans, overdue bills, credit card balances, and any other. Borrow from $2, - $45, to consolidate debt · A quick online application to closing process · One fixed interest rate and monthly payment · and month.

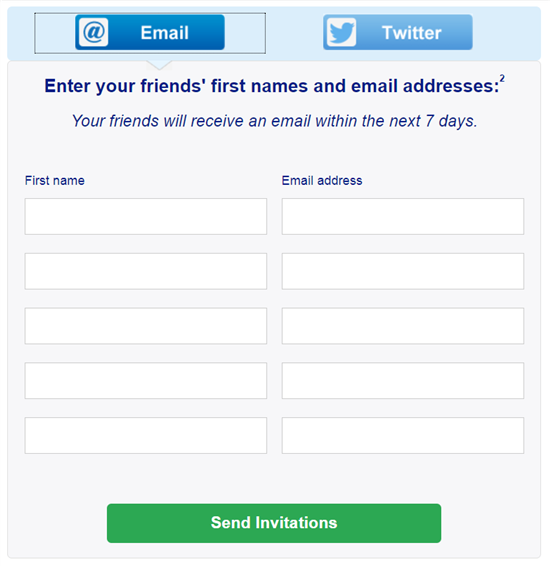

How To Refer A Friend To Chase

You are eligible to receive a "Refer-A-Business" bonus for each referral that opens a qualifying business checking account - up to a total of $1, per. enjoy this special offer. Refer a Friend. Chase Bank refer a friend for checking accounts. Existing eligible Chase checking customers can refer a friend to bank. Earn up to $ cash back per year. You can get $50 cash back for each friend who gets any participating Chase Freedom® credit card. Find your friends' Chase Sapphire Preferred referral links and share your own. Get bonus points when you sign up using a friend's Chase Sapphire. Refer a friend. Do you have a friend or colleague who is thinking of making a career move? It really is that simple! Please note that you will receive a. Existing eligible Chase checking customers can refer a friend to bank with Chase and earn a cash bonus. JPMorgan Chase Bank, N.A. is a wholly-owned subsidiary. Just apply through the referral and then ask Chase to match after you get approved. Your friend will get the 10k for referring and you'll get your offer bumped. This offer is a great little extra of £20 on top of 1% cashback and % on savings. Plus existing customers can earn up to £ by referring their friends. To get the welcome offer, your friends must apply for the specific card you linked to in your referral link. If they apply for another card — even if it's part. You are eligible to receive a "Refer-A-Business" bonus for each referral that opens a qualifying business checking account - up to a total of $1, per. enjoy this special offer. Refer a Friend. Chase Bank refer a friend for checking accounts. Existing eligible Chase checking customers can refer a friend to bank. Earn up to $ cash back per year. You can get $50 cash back for each friend who gets any participating Chase Freedom® credit card. Find your friends' Chase Sapphire Preferred referral links and share your own. Get bonus points when you sign up using a friend's Chase Sapphire. Refer a friend. Do you have a friend or colleague who is thinking of making a career move? It really is that simple! Please note that you will receive a. Existing eligible Chase checking customers can refer a friend to bank with Chase and earn a cash bonus. JPMorgan Chase Bank, N.A. is a wholly-owned subsidiary. Just apply through the referral and then ask Chase to match after you get approved. Your friend will get the 10k for referring and you'll get your offer bumped. This offer is a great little extra of £20 on top of 1% cashback and % on savings. Plus existing customers can earn up to £ by referring their friends. To get the welcome offer, your friends must apply for the specific card you linked to in your referral link. If they apply for another card — even if it's part.

Refer a friend to Chase and get £20 each! Go on, share the love. 18+, UK residents. T&Cs apply. How to Earn a Credit Card Referral Bonus? · Step 1: Check your Eligibility. First, verify whether your credit card offers a referral program, as not all banks. Do you have a Chase checking account? If so, you might be eligible for a lucrative referral program that can earn you up to $ per calendar year. Would you like to refer a friend or family member to us? We would be happy © Chase Ins. All Rights Reserved. Website design by DIF Design. Our systems indicate that you already have the Refer-A-Friend website open. Repeat. Refer. Invite Your Network. Reward. Earn Rewards. Repeat. Refer Again. {{. All you have to do is log in to your American Express portal and head to “refer-a-friend” to see this bonus and get your referral link! ⛔ Cards not included. Chase Credit Card Refer a Friend. Chase offers a number of referral programs for its credit cards, including the Chase Freedom® Flex card, the Chase Sapphire. You are eligible to receive a "Refer-A-Business" bonus for each referral that opens a qualifying business checking account - up to a total of $1, per. Receive $50 when you Refer a Friend to HVAC professionals Chase Heating & Cooling in Oregon City. for checking accounts. Existing eligible Chase checking customers can refer a friend to bank with. Chase and earn a cash bonus. I referred my sister for a chase freedom card on 12/28/22 and saw her use the link and get approved instantly. She then activated the card mid January. I still. If you have a credit card and like it enough to refer one of your friends then you can usually get a bonus in points or cash for referring them! Once your friend opens a new account and meets the requirements, the referral bonuses are credited to both accounts. Chase referrals are a fantastic way to earn. This offer is a great little extra of £20 on top of 1% cashback and % on savings. Plus existing customers can earn up to £ by referring their friends. Find a Chase referral code here. The Chase referral scheme is no longer active. You can find alternatives here. How Does Capital One's Card Referral Program Work? The first step is to sign in to your account to get your personal referral link. · What is the referral bonus? Chase credit card members can refer friends for a variety of cards. The amount of rewards you can earn per referral and each year varies by card. Here are some. Would you like to refer a friend or family member to us? We would be happy © Chase Ins. All Rights Reserved. Website design by DIF Design. Find your friends' Chase Freedom Cards referral links and share your own. Get $ cash back when you apply for a new Chase Freedom Flex or Chase Freedom. However, current customers can use the refer-a-friend program to earn up to $ per year when a friend or family member opens a new Chase checking account.

How To Remove Collections Accounts From Credit Report

Like other negative information, a collection account can remain on your credit reports for up to seven years from the date you first miss a payment to the. Creditors and debt collectors have no obligation to remove charge-offs from a credit report. Ensure you get everything in writing if you're able to work out a. If you have accounts in collection, negotiate the largest discount to your balance owed and pay it (get a pay-for-delete agreement if possible). You can try to negotiate with the collection agency to have the collection removed. You would pay a fee to the collection agency and they would stop reporting. 1. Send a dispute. One possible way to get a collection account off your credit report is to dispute the account. Transunion · Ask the credit bureau to remove or correct the inaccurate or incomplete information. · Include: your complete name and address; each mistake that you. You will have to call the collections agency directly, not your apartment, and ask for a "pay for delete". Ask that since the debt will be. Mistakes happen. The first step to removing a collection is asking the debt collector for a validation letter to prove the debt is yours. If they can't offer. Verify the Collection: Before taking any action, ensure the collection is accurate. · Dispute Inaccuracies · Negotiate a “Pay-for-Delete” · Settle the Debt. Like other negative information, a collection account can remain on your credit reports for up to seven years from the date you first miss a payment to the. Creditors and debt collectors have no obligation to remove charge-offs from a credit report. Ensure you get everything in writing if you're able to work out a. If you have accounts in collection, negotiate the largest discount to your balance owed and pay it (get a pay-for-delete agreement if possible). You can try to negotiate with the collection agency to have the collection removed. You would pay a fee to the collection agency and they would stop reporting. 1. Send a dispute. One possible way to get a collection account off your credit report is to dispute the account. Transunion · Ask the credit bureau to remove or correct the inaccurate or incomplete information. · Include: your complete name and address; each mistake that you. You will have to call the collections agency directly, not your apartment, and ask for a "pay for delete". Ask that since the debt will be. Mistakes happen. The first step to removing a collection is asking the debt collector for a validation letter to prove the debt is yours. If they can't offer. Verify the Collection: Before taking any action, ensure the collection is accurate. · Dispute Inaccuracies · Negotiate a “Pay-for-Delete” · Settle the Debt.

How long do closed accounts stay on my credit report? First, contact the creditor or collections agency and verify that the account in collections is accurate. If a paid collection on your credit reports is accurate, you can still get it removed early. One method is to ask the current creditor —the original creditor. If enough time passes following a late payment, the creditor may transfer your account to a collection agency or sell your debt to a third party. In this. In exchange for full or partial payment, the collector agrees to remove a collection account from your credit report. In theory, that eliminates the credit. The best scenario is a Pay For Delete, whereby you make an agreement with the creditor or collection agency to remove/withdraw the item upon. How to remove collections from your credit report · Option 1: Dispute the account · Option 2: Send a pay for delete letter · Option 3: Request a goodwill deletion. How to Get a Paid Debt Off Of Your Credit Report · Write a Goodwill Letter · Dispute the Collection · Ask the Collection Agency for Validation · Pay for Delete. In short, what works is writing a pay for delete letter, waiting it out and asking for removal due to goodwill. Many debt collection agencies, even if they generally don't delete paid accounts from credit reports, often do not report accounts that are settled before their. However, credit reporting agencies discourage the pay for delete practice as they require debt collectors who report accounts to the credit bureaus to provide. Request a goodwill deletion. Ask the collection agency to remove the collection account upon paying off. · Dispute the collection account. · Negotiate a pay-for-. It's crucial to act immediately when you suspect a wrongful collection, by disputing it with both the creditor and the credit reporting agencies. How to Remove Old Debt From Your Credit Report · 1. Pull your free credit reports · 2. Find out when the debt will fall off · 3. File a dispute · 4. Get outside. If you have a collection account on your credit report, you may be able to have it removed by disputing the debt with the credit bureaus. This involves sending. It's crucial to act immediately when you suspect a wrongful collection, by disputing it with both the creditor and the credit reporting agencies. The account will be marked on your credit report with a "collection" status. 2. What is a third-party collection? Third-party collections are collection efforts. The account will be marked on your credit report with a "collection" status. 2. What is a third-party collection? Third-party collections are collection efforts. Prepare a dispute letter to mail to Experian, Equifax & TransUnion requesting the fraudulent account(s) be removed from your credit reports. A sample letter can. Pay for delete refers to the process of getting a debt collector to remove collection account removed from your credit report. Pay for delete refers to the process of getting a debt collector to remove collection account removed from your credit report.

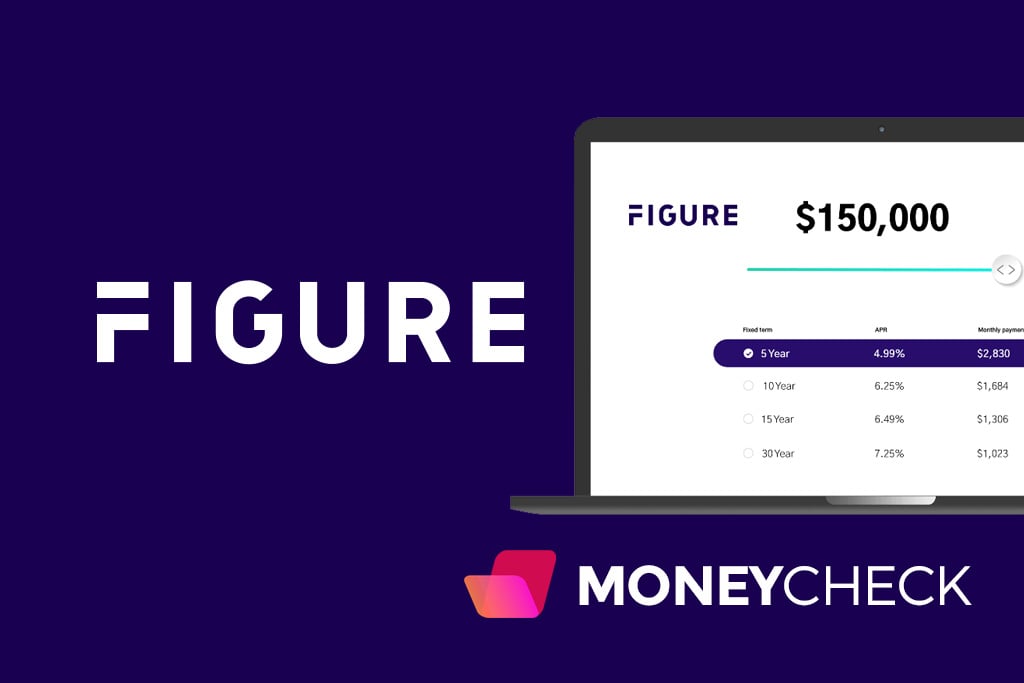

Figure Heloc

Calling loan originators. Meet Figure Connect. We've created the first loan exchange that uses standardized loan origination software and. % of our customers used their HELOC for roof and HVAC repairs. Secure your home's future with Figure and get peace of mind knowing your. HELOCs are lines of credit that are secured by your home. Figure Lending LLC requires you to take the full draw at the time of origination. Figure Technologies doubles down on HELOC offerings. November 3, The fintech rolled out a Lending-as-a-Service (LaaS) platform, which gives lenders. View the SEC offering information from Figure HELOC Access Fund, LLC, a Reg D filing. 5-Day HELOC Program. Learn how you can access Home Equity fast. CMG offers a financing solution that can turn your home equity into cash in as little as 5 days. Rate has partnered with Figure, the #1 non-bank HELOC lender who has more than $ billion in loans approved. Did you hear? We've lowered our rates! A Figure HELOC is still one of the fastest ways to turn your home equity into cash. Discover the benefits of Figure's HELOC - lower monthly payments, better rates, and flexible terms. Say goodbye to average personal loans! indo877.site Calling loan originators. Meet Figure Connect. We've created the first loan exchange that uses standardized loan origination software and. % of our customers used their HELOC for roof and HVAC repairs. Secure your home's future with Figure and get peace of mind knowing your. HELOCs are lines of credit that are secured by your home. Figure Lending LLC requires you to take the full draw at the time of origination. Figure Technologies doubles down on HELOC offerings. November 3, The fintech rolled out a Lending-as-a-Service (LaaS) platform, which gives lenders. View the SEC offering information from Figure HELOC Access Fund, LLC, a Reg D filing. 5-Day HELOC Program. Learn how you can access Home Equity fast. CMG offers a financing solution that can turn your home equity into cash in as little as 5 days. Rate has partnered with Figure, the #1 non-bank HELOC lender who has more than $ billion in loans approved. Did you hear? We've lowered our rates! A Figure HELOC is still one of the fastest ways to turn your home equity into cash. Discover the benefits of Figure's HELOC - lower monthly payments, better rates, and flexible terms. Say goodbye to average personal loans! indo877.site

You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. Could Figure Home Equity Line of Credit be the right HELOC lender for your situation? Here are your possible options to find the best HELOC for you. Homebridge HELOC is an open-end product where the full loan amount (minus Figure Cookie Policy Figure Privacy Policy. Allow All. Manage Consent. What is a Home Equity Line of Credit (HELOC)? · Smart ways to use home equity · Read more home equity articles». Explore current rates and other financing. Figure HELOCs. Unlike a traditional HELOC that offers a revolving line of credit over a predetermined draw period, a Figure HELOC grants the entire loan amount. For example, lenders like Synergy One Lending and Figure offer a HELOC that is powered by blockchain technology to provide a more efficient process for the. A Movement HELOC is secured with your home as collateral, whereas personal Figure Cookie Policy Figure Privacy Policy. Allow All. Manage Consent. % of our customers used their HELOC for roof and HVAC repairs. Secure your home's future with Figure and get peace of mind knowing your. A HELOC loan or Home Equity Line of Credit is a second mortgage with a revolving line of credit borrowed against the equity of your home; learn about. To figure out your DTI, you'll start by adding up all your monthly payments. Take some time and sit down to get all of your expenses and monthly payments. Figure's HELOC is designed differently from most other HELOCs, however. A Figure HELOC entails borrowing the full amount upfront. Then, once some of the loan is. Although a HELOC can be a great way to fund life's expenses, obtaining the line of credit can be a time-consuming process. But there is one company that is. Women are increasingly tapping into their home equity with Figure. Empower your financial future and take control with a Figure HELOC. Join the. Because of this impact on my credit report, I am paying 24% on $60, of credit card debt instead of 8% on an average heloc loan, the typical loan they. Through the Figure Home Equity Line Of Credit (HELOC) affiliate program, your page viewers can access reliable home equity that brings them closer to their. Could Figure Home Equity Line of Credit be the right HELOC lender for your situation? Here are your possible options to find the best HELOC for you. [email protected] Sue Maki | Fairway Home Loans. “I have been referring my clients to FIGURE's. HELOC for about a year now. Here are the three BEST things. Figure · @Figure. Our HELOC offers fast funding and flexible borrowing options to make your backyard oasis a reality. Apply online now. Technically, Figure's Home Equity Line is a HELOC. But it includes some unusual limitations on credit line draws and isn't as flexible as a typical HELOC. Do you agree with Figure's 4-star rating? Check out what people have written so far, and share your own experience.

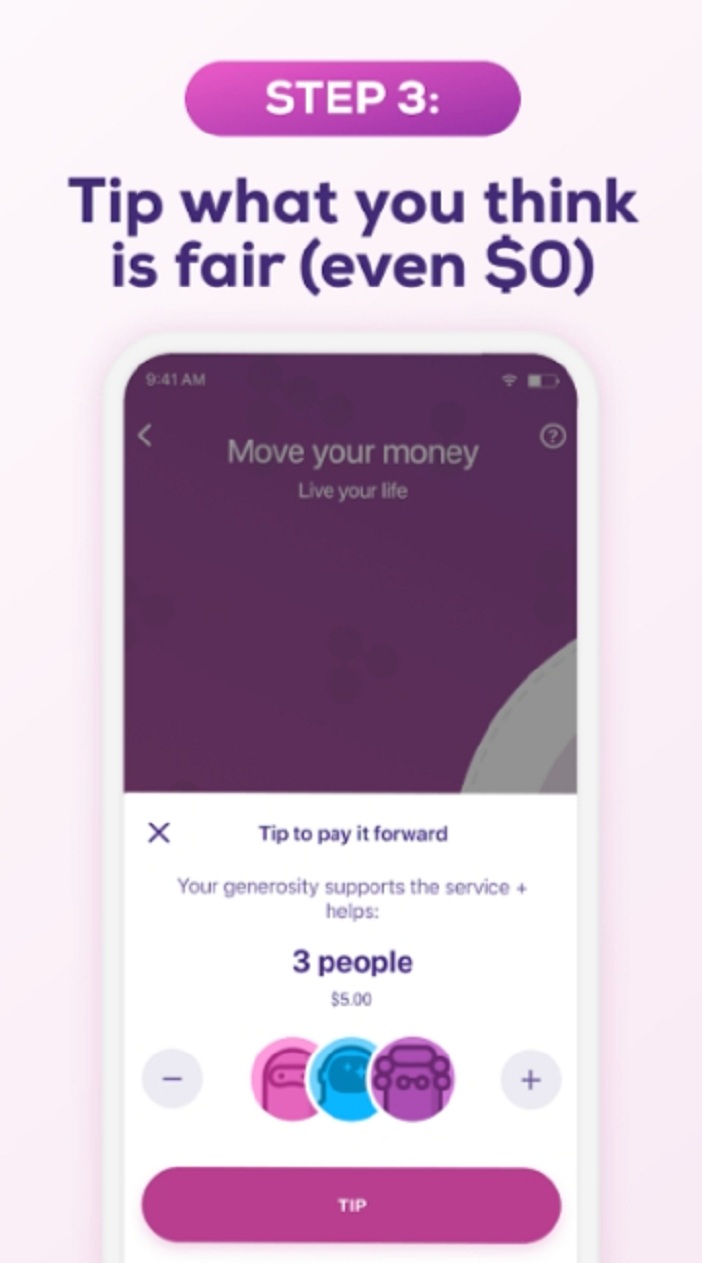

Best Early Paycheck Apps

EarnIn is an app that gives you access to the pay you've earned - when Cash in on an early paycheck. No need to switch banks. Your direct deposit. With a Chime Checking Account, you can set up early direct deposit in the Chime app to access your entire paycheck up to two days early1 – with no fees in sight. ✓ EarnIn: Distinguished by its unique model that allows users to access earned wages ahead of payday, EarnIn offers a free cash advance app. When payday rolls around, Chime will take back the amount you borrowed with no interest and no fees. Chime also lets you withdraw paycheck funds up to two days. Duke employees enrolling in this voluntary program can access their pay in advance through the DailyPay or myWisely app, both available for download on iOS and. Currently, Fifth Third Bank is improving your Online Banking site with scheduled maintenance to better serve you. Get a paycheck advance with early. DailyPay is the easiest, most secure way to access your earned wages before payday. Get your money when you need it to pay bills on time, avoid late fees. Best Cash Advance Apps of · Best Overall, Best for Fast Funding With a Low Fee: Varo · Runner-Up Best Overall, Best for Flexible Loan Amounts: Payactiv · Also. Dave is a cash advance app that works best for people who aren't living paycheck to paycheck. The required Dave Extra Cash Account is a spending account in. EarnIn is an app that gives you access to the pay you've earned - when Cash in on an early paycheck. No need to switch banks. Your direct deposit. With a Chime Checking Account, you can set up early direct deposit in the Chime app to access your entire paycheck up to two days early1 – with no fees in sight. ✓ EarnIn: Distinguished by its unique model that allows users to access earned wages ahead of payday, EarnIn offers a free cash advance app. When payday rolls around, Chime will take back the amount you borrowed with no interest and no fees. Chime also lets you withdraw paycheck funds up to two days. Duke employees enrolling in this voluntary program can access their pay in advance through the DailyPay or myWisely app, both available for download on iOS and. Currently, Fifth Third Bank is improving your Online Banking site with scheduled maintenance to better serve you. Get a paycheck advance with early. DailyPay is the easiest, most secure way to access your earned wages before payday. Get your money when you need it to pay bills on time, avoid late fees. Best Cash Advance Apps of · Best Overall, Best for Fast Funding With a Low Fee: Varo · Runner-Up Best Overall, Best for Flexible Loan Amounts: Payactiv · Also. Dave is a cash advance app that works best for people who aren't living paycheck to paycheck. The required Dave Extra Cash Account is a spending account in.

Employees can view and request their earned wages via desktop or the mobile app. When requests are made by noon CT, funds are available on the same day. With Tapcheck on-demand pay, you can transfer your earnings directly to your bank account within minutes. Feeling better just thinking about it, aren't you? B9 is an app that gives you early access to up to $ of your paycheck per pay period.B9 Visa® Debit Card With up to 5 % cashback included. The all-in-one money app. Budget. Save. Spend. Invest. All in one Get paid early. Fee-free ATMs. Learn more .. Saving. Save automatically. Instantly access your pay in advance — without waiting for a paycheck. EarnIn lets you access your pay as you work — not days or weeks later. An on-demand pay platform that delivers early access to earned wages and works with all HR/HCM/payroll systems. Get the most out of your pay by using the DailyPay app and DailyPay Card. Revolut is a financial technology company that makes it easy to access your entire paycheck early — up to 2 days before your scheduled payday with a qualifying. Easy way to borrow, save, invest, and earn. All in one app. Varo. Online bank accounts with no minimum balance. 4 Cash Advance Apps (With No Direct Deposit Required) ; 1 — Dave · Up to $ per pay period · banking days. Instant feature expedites the process for $$. The Payactiv app puts you in control of your earning, spending, and saving so you can access your pay when you need it, stretch every dollar, and achieve your. Your payday can't come soon enough! That's where we come in. You can get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. Chime, CashApp, Albert, are some good options. The same day pay ones to look into are DailyPay or Empower. Control how you spend, budget, and deposit money with the Dave Checking account. You can also get your paycheck up to 2 days early with direct deposit2. Rain works with employers to customize Earned Wage Access for their employees, offering best practices and in-app controls. Thought awesome this is cool! Borrow 2 weeks early no problem! Flash 5 months later my WHOLE paycheck goes to cash advance apps, im talking. Earnin is our pick for the best overall app for borrowing money because of its “Cash Out” option, which can give you access to your paychecks early. “I've been using this app for 7 months now and it's great. I can transfer money easily It shows my every transaction It's very easy to use.” Read more. APP. Wagetap gives you an instant cash advance of up to $ before your payday, so you can use your money now when you need it. Download our app today to get. Need early access to your paycheck? Find out how to get paid early with paycheck advance options from Huntington Bank.

How Can I Get Rid Of Credit Card Debt

Go to a good local credit union. (I've also heard fidelity can be helpful). Ask them for help consolidating and paying down your credit cards. 5 Steps To Assess Your Spending · Commit to a Payment Amount · Choose a Payment Strategy · Consider Balance Transfer Credit Cards · Research Debt Consolidation. Consider consolidating your debts with a consolidation loan or transferring your credit card balances to a low rate balance transfer credit card. However, make. Step 1: Face credit card debt head-on · Gather the monthly statements from all your credit cards. · Write down the interest rate, payment due date, missed payment. Target one debt at a time · Focus on high-interest debt · Try the snowball method ; Consolidate debt · Transfer balances · Tap into your home equity ; Review your. 6. Use the Avalanche Method The Most Popular Way to Get Out of Credit Card Debt – Some Claim It's the Best Many people have found that the Avalanche Method. 1. If you're in a bind, talk to your credit card issuer · 2. Identify the cause of your credit card debt · 3. Choose a payoff strategy that works for you · 4. Credit Card Help Center. We understand that these are trying financial times. If you are struggling with credit card debt, we'd like to help. If you are. Build an emergency fund. Setting aside a fund for when unexpected expenses or periods of financial hardship happen is your greatest defence against credit card. Go to a good local credit union. (I've also heard fidelity can be helpful). Ask them for help consolidating and paying down your credit cards. 5 Steps To Assess Your Spending · Commit to a Payment Amount · Choose a Payment Strategy · Consider Balance Transfer Credit Cards · Research Debt Consolidation. Consider consolidating your debts with a consolidation loan or transferring your credit card balances to a low rate balance transfer credit card. However, make. Step 1: Face credit card debt head-on · Gather the monthly statements from all your credit cards. · Write down the interest rate, payment due date, missed payment. Target one debt at a time · Focus on high-interest debt · Try the snowball method ; Consolidate debt · Transfer balances · Tap into your home equity ; Review your. 6. Use the Avalanche Method The Most Popular Way to Get Out of Credit Card Debt – Some Claim It's the Best Many people have found that the Avalanche Method. 1. If you're in a bind, talk to your credit card issuer · 2. Identify the cause of your credit card debt · 3. Choose a payoff strategy that works for you · 4. Credit Card Help Center. We understand that these are trying financial times. If you are struggling with credit card debt, we'd like to help. If you are. Build an emergency fund. Setting aside a fund for when unexpected expenses or periods of financial hardship happen is your greatest defence against credit card.

A balance transfer can help move debt from several cards onto one card with a single due date. This can simplify repayments and lower your interest rate. Time. Know your budget · List out your credit card debts, minimum payments, and APR · Select a credit card debt reduction strategy: snowball method vs. · Automate your. Reach out to your credit card issuer directly and ask for help. Payment holidays for up to three months, deferred payments and delayed principal payments are a. You might have heard the term "debt consolidation" used in reference to credit card debt. It's the strategy of combining multiple credit card debts into a. 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a time. · 4. Consolidate credit card debt. · 5. Start by understanding your finances: Work out your monthly budget and follow it · Add a rainy-day fund to your budget · Set aside an amount to repay your credit. Experts tend to recommend one of two methods for paying off credit card debt: the debt snowball method or the debt avalanche method. A debt consolidation loan may work similarly to a balance transfer card. Debt consolidation loans are personal loans you can use to pay off multiple debts and. Managing Debt · Track your spending to see where the money goes, relative to your income. · Find out how much you need each month to make all your payments. · Make. If you are unable to bring down the debt through increased repayments, you can ask your credit card company for a repayment plan. Your credit card company is. How do I pay off credit card debt? · Start by understanding your finances: Work out your monthly budget and follow it · Add a rainy-day fund to your budget · Set. Adjust Your Budget; Use a Debt Repayment Strategy; Look for Additional Income; Consider Credit Counseling; Consider Consolidating Your Debt; Don't Forget About. The first step to reducing credit card debt is to identify and eliminate unnecessary expenses, such as entertainment or luxuries. After that, it is important to. 8 Tips to Manage and Reduce Credit Card Debt · 1. Continue to Pay Your Credit Card Bills on Time · 2. Practice Responsible Spending · 3. Choose a Credit Card. Debt settlement companies encourage you to stop paying credit card bills and instead require regular payments into a third-party account they manage. 1. Contact your credit card companies · 2. Understand the two ways to pay off credit card debt · 3. Consider a debt management plan · 4. Participate in credit. Meanwhile, contact a nonprofit credit counseling service to help you get reorganized, and to go to bat on your behalf. Well, at least when the negotiations are. How a year-old paid off $16, in credit card debt in less than a year (and hasn't paid a cent in interest since) · Step 1: She calculated her budget · Step 2. A balance transfer can help move debt from several cards onto one card with a single due date. This can simplify repayments and lower your interest rate. Time. Consider setting up automatic transfers to your savings account every payday. That way, you can put aside money for your card payments before you have a chance.

Banks That Use Vantagescore 3.0

For example, an auto lender might use a FICO Auto Score, and a landlord or agency might run your credit through VantageScore You're more likely to use. In , the 3 major credit bureaus – Experian, TransUnion, and Equifax – joined forces to create a VantageScores® credit scoring model to compete with FICO. Understand the difference between VantageScore and FICO, and learn how to locate a mortgage lender that uses VantageScore for credit reporting. Banks, credit unions and other lenders use credit scores to make decisions VantageScore for consumer loans (vehicle, personal and credit cards). Not necessarily true. Synchrony is one of the few known lenders who use Vantage scoring for credit-granting purposes. lenders and financial institutions can use to determine someone's creditworthiness. Most common credit scoring models, including FICO® and VantageScore More than 3, institutions use VantageScore credit scores to provide consumer credit products like credit cards, auto loans, personal loans and mortgages. Lenders use a variety of credit scores and are likely to use a credit score different from VantageScore® to assess your creditworthiness. Subscription. The bureaus (Experian, Equifax, TransUnion), also sell their own credit scores, often based on the VantageScore formula, or their own. For example, an auto lender might use a FICO Auto Score, and a landlord or agency might run your credit through VantageScore You're more likely to use. In , the 3 major credit bureaus – Experian, TransUnion, and Equifax – joined forces to create a VantageScores® credit scoring model to compete with FICO. Understand the difference between VantageScore and FICO, and learn how to locate a mortgage lender that uses VantageScore for credit reporting. Banks, credit unions and other lenders use credit scores to make decisions VantageScore for consumer loans (vehicle, personal and credit cards). Not necessarily true. Synchrony is one of the few known lenders who use Vantage scoring for credit-granting purposes. lenders and financial institutions can use to determine someone's creditworthiness. Most common credit scoring models, including FICO® and VantageScore More than 3, institutions use VantageScore credit scores to provide consumer credit products like credit cards, auto loans, personal loans and mortgages. Lenders use a variety of credit scores and are likely to use a credit score different from VantageScore® to assess your creditworthiness. Subscription. The bureaus (Experian, Equifax, TransUnion), also sell their own credit scores, often based on the VantageScore formula, or their own.

There are different credit scoring models which may be used by lenders and insurers. Your lender (including b1BANK) may not use VantageScore , so don't. U.S. Bank does not use your VantageScore to make credit decisions. Free credit score example - Transunion VantageScore® Set yourself up for credit. VantageScore score based on TransUnion data. The only way to know for sure is to ask the lender which credit report and which credit score version it. Do Only Banks and Lenders Use Credit Scores? Any institution that lends VantageScore® does not take paid collections accounts into account in its. Eight of the top 10 banks, and 30 of the top 50 banks use VantageScore credit scores. Usage of VantageScore is widespread across loan types however the top. The VantageScore Footprint. Over 3, banks, fin-techs and other companies use VantageScore credit scores every day to assess consumer creditworthiness. VantageScore and forward. Updates to As of , Synchrony Bank uses VantageScore as the credit score for granting its credit cards. Do banks use VantageScore? VantageScore is available to customers of Capital One, Chase, and US Bank when they login to their accounts. The VantageScore has built upon the VantageScore According to Do mortgage lenders use VantageScore? According to VantageScore, billion. Lenders use your credit score to help determine if you qualify for a Credit Score Plus uses VantageScore through Experian.* Scores range from. Using VantageScore® for Mortgages Recently, the Federal Housing Finance Agency (FHFA) approved the use of VantageScore for lenders who sell loans to. Moving from the current Classic FICO credit score model to require lenders to use two credit scores generated by the FICO Score 10 T and the VantageScore There is no one credit score used by all lenders and creditors, since there are so many credit scoring models. But knowing the differences in calculation. VantageScore is a popular credit scoring model lenders use to assess your financial responsibility Unlike the VantageScore , which only looked at your. Some Lenders Use VantageScore, Not FICO The latest version, VantageScore , and its predecessor, VantageScore , score consumers using a range from to. In this article, we will discuss: The differences between VantageScore and models; Who uses the VantageScore model; The average credit score based. Research conducted by Charles River Associates found VantageScore credit score usage among banks VantageScore remains the most commonly used one. VantageScore , which is a completely different credit scoring model than FICO. Auto lenders use FICO Auto Scores 2, 4, 5, 8 and 9; Credit Card Issuers use. Last year, over 27 billion VantageScore credit scores were used representing a 42% yearly increase. Most top 10 US banks, large credit unions and leading fin-. VantageScore considers the following factors when calculating your score Most, but not all, lenders use FICO® Scores to determine a consumer's.

Easy Home Budget Worksheet

Explore professionally designed budget templates you can customize and share easily from Canva. Use this worksheet to create your household spending plan/budget. Not all categories will be applicable to you and you might add categories that you want to. Use the following worksheet to help develop your budget. Details, Average Monthly Payment. Housing Expenses. Electricity, $. Heating costs, $. Mortgage . Home · Publications. Make a Budget - Worksheet. image of Make a Budget This one-page budget worksheet helps you plan and track your spending. Get a. Basic Finances. Basic Finances Overview · Managing Your At its core, a budget is a worksheet with separate categories for income, expenses, and savings. It works well for college students who want to budget money easily, parents who want to control the household expenses with the printable family budget template. This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically. Quicken offers a FREE, easy-to-use budgeting calculator to help you understand your expenses and manage your money. Get started building your budget right. Use this worksheet to see how much money you spend this month. Then, use this month's information to help you plan next month's budget. Explore professionally designed budget templates you can customize and share easily from Canva. Use this worksheet to create your household spending plan/budget. Not all categories will be applicable to you and you might add categories that you want to. Use the following worksheet to help develop your budget. Details, Average Monthly Payment. Housing Expenses. Electricity, $. Heating costs, $. Mortgage . Home · Publications. Make a Budget - Worksheet. image of Make a Budget This one-page budget worksheet helps you plan and track your spending. Get a. Basic Finances. Basic Finances Overview · Managing Your At its core, a budget is a worksheet with separate categories for income, expenses, and savings. It works well for college students who want to budget money easily, parents who want to control the household expenses with the printable family budget template. This Excel template can help you track your monthly budget by income and expenses. Input your costs and income, and any difference is calculated automatically. Quicken offers a FREE, easy-to-use budgeting calculator to help you understand your expenses and manage your money. Get started building your budget right. Use this worksheet to see how much money you spend this month. Then, use this month's information to help you plan next month's budget.

Easy Monthly Budget Tracker - Monthly Budget Template - Printable Budget Worksheet - US Letter Home Budget Planner - Worksheet. Monthly bills. Think of these as expenses you've committed to pay every month. Communication. Monthly Budget Worksheet. Use this worksheet to see how much. This simple yet effective Personal Monthly Budget template will help you cope with financial challenges. Financial Planning Made Easy Thanks to Budget. Consumer Financial Protection Bureau prepared the tools included in the Your Money, Your Goals: Focus on People with Disabilities companion guide as a. Simplify your monthly or weekly budgeting by using a free, customizable budget template. Monitor all of your home or business expenses accurately and decide. Download free Excel Budget Templates for creating family, personal, business, and household budgets. Setting a budget for yourself is hard — and following it can be even harder. Using monthly budget sheets helps make it easier. This detailed template offers a. HOUSEHOLD BUDGET TEMPLATE_Google-Sheet. Household Budget Template; Example: Household Budget Template. A, B, C, D, E, F, G, H, I, J, K, L, M, N, O. 1. 2. Budgeting is one of the best ways to keep your finances on track. This budget planner makes it easy to get started. To protect your privacy, we won't save. Canada's best Excel budget calculator spreadsheet guides you in creating a personal household budget. Easy template incl. spending guidelines & tips to. Sheet1. A, B, C, D, E, F. 1, Household Budget Worksheet. 2, Enter your estimated monthly income and expenses to better understand what changes you should make. Interest Income, , Home / Rental Insurance, 8. Dividends, , Electricity, 9. Refunds / Reimbursements, , Gas / Oil, Accruals are an easy way to avoid it. Just conservatively estimate Monthly Budget Planner (Google Spreadsheet). 89 upvotes · Home · Debt information · Your financial situation. dad and daughter cooking. Need Ways to make budgeting easier Income and expenditure financial statement. Finding extra money to save becomes easier when you know exactly what you're spending each month. Fidelity believes your essential expenses (things you need. Easily create a budget for your expenses with our free budget templates. Learn about different types of monthly budgets and find the one that works for you. Top Excel Budget Templates. We've provided you with the best free budget template selection around, whether you're managing a personal budget, an industry-. 1. Premium Budgeting Spreadsheet · 2. Household Budgeting Spreadsheet · 3. Financial Snapshot and Budget · 4. Williams Budgeting Sheet · 5. Free Budget Template · 6. Total Expenses. Actual Net Total (total income - total expenses). Home. A u to. P ersonal. Sa vings. MONTHLY BUDGET WORKSHEET. Expenses. Income. $ $